Statement of Comprehensive Income Format, Examples

When your business accrues gains or losses from the fluctuations in value of its assets, it’s not recognized in the net income. The income statement is one of the financial statements that companies publish. It generally recognizes earned income from sales and expenses such as the cost of goods sold and tax expenses. When preparing the income statement (or statement of comprehensive income) it’s important to note that discontinued operations amounts should be reported net of tax. The third section of the statement of cash flows reports the cash received when the corporation borrowed money or issued securities such as stock and/or bonds. Since the fixed assets cash received is favorable for the corporation’s cash balance, the amounts received will be reported as positive amounts on the SCF.

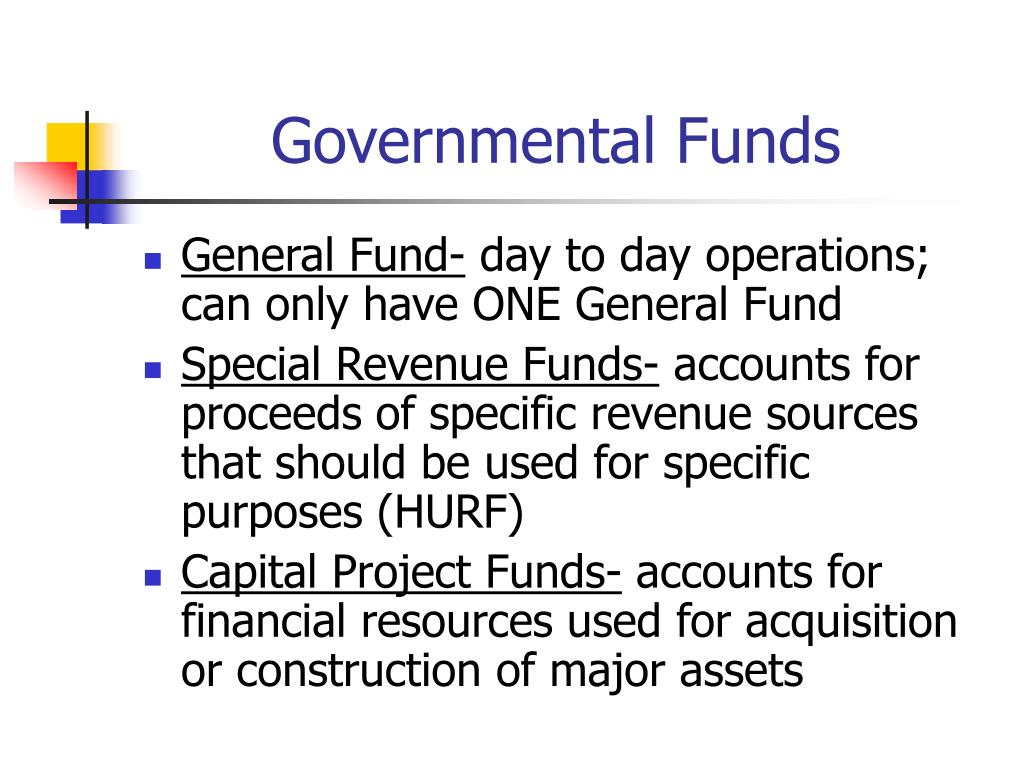

Intermediate Financial Accounting 1

- It should also be noted that since the assets are discontinued, no depreciation is taken on the assets since they are not actively used in generating income.

- The gross margin, or the amount gained from the sale of your goods and services, will be determined by this calculation.

- (d) The income tax relating to each component of other comprehensive income is disclosed in the notes.

- The $30,000 received from selling an investment also had a favorable effect on the corporation’s cash balance.

- A company’s income statement details revenues and expenses, including taxes and interest.

- Keeping track of your financial statements and reports is crucial for small business owners.

If you want to scale and grow your business, you have to pay attention to these statements. As mentioned, the statement of comprehensive income is a combination of the statement of comprehensive income format income statement and the OCI. This financial document brings business events to light and can be used for numerous purposes, which we will review further in this section.

- When your business accrues gains or losses from the fluctuations in value of its assets, it’s not recognized in the net income.

- This number is then transferred to the balance sheet as accumulated other comprehensive income.

- Gains or losses can also be incurred from foreign currency translation adjustments and in pensions and/or post-retirement benefit plans.

- Here’s a snapshot of how you need to format your consolidated statement of comprehensive income.

- The multiple-step format with its section subtotals makes performance analysis and ratio calculations such as gross profit margins easier to complete and makes it easier to assess the company’s future earnings potential.

- In its first quarter filing for 2023, it published its consolidated statements of comprehensive income, which combines comprehensive income from all of its activities and subsidiaries (featured below).

What’s the Benefit of the Comprehensive Income Statement?

This number is then transferred to the balance sheet as accumulated other comprehensive income. Other comprehensive income includes many adjustments that haven’t been realized yet. These are events that have occurred but haven’t been monetarily recorded in the accounting system because they haven’t been earned or incurred.

Consolidated Statement of Comprehensive Income format

It gives a more complete picture of the financial results by including items that are not reflected in the income statement, and helps investors and analysts assess the long-term financial prospects of the business. Whenever CI is listed on the balance sheet, the statement of comprehensive income must be included in the general purpose financial statements to give external users details about how CI is computed. You’ll need to print a normal trial balance report to generate an income statement for your company. Administrative documents that indicate the end balances of each account in the general ledger for a certain reporting period are known as trial balance reports. Making balance sheets is an important part of making an income statement since it’s how a business collects data for account balances. It will provide you with all of the end-of-period numbers you’ll need to make an income statement.

Accounting Ratios

In other words, it adds additional detail to the balance sheet’s equity section to show what events changed the stockholder’s equity beyond the traditional net income listed on the income statement. The cash outflows spent to purchase noncurrent assets are reported as negative amounts since the payments have an unfavorable effect on the corporation’s cash balance. This is the property, plant and equipment that will be used in the business and was acquired during the accounting period. The amounts of these other comprehensive income adjustments (positive or negative) are not included in the corporation’s net income, income statement, or retained earnings.

What’s Included

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in https://www.bookstime.com/ teaching accounting online. Comprehensive income is the sum of a company’s net income and other comprehensive income. To get a more inside look at an organization, look for other statements that are from previous 10 years of financial records and try to spot a trend. It will assist you in determining the risk-to-reward ratio even before you invest in the company. It is worth noting that these issues are uncommon in small and medium-sized firms.

Share This Book

The negative amount may lead to the question “Was there a decline in the demand for the corporation’s products? ” Perhaps some of the corporation’s items in inventory have become obsolete. A revaluation surplus on a financial asset classified as FVTOCI is a good example of a bridging gain. The asset is accounted for at fair value on the statement of financial position but effectively at cost in SOPL. As such, by recognising the revaluation surplus in OCI, the OCI is acting as a bridge between the statement of financial position and the SOPL.

Generally, management teams and investors look at the income statement to assess the profitability of the company. Net income is located on the income statement and is calculated by subtracting all expenses and taxes from the company’s total revenue. Many companies note other comprehensive income as a footnote to their financial statements. Alternatively, components of other comprehensive income could be presented, net of tax. Refer to the statement of comprehensive income illustrating the presentation of income and expenses in one statement.

Statement of Comprehensive Income Format, Examples Leer más »