We publish blogs, tutorial videos, free templates and more that address every aspect of managing a project and as it applies to many different industries. Here are a handful of links to stories about production management in manufacturing. Capacity utilization measures how much of a plant’s production capacity is in use. This helps to determine the efficiency of the plant but also can assess its future growth. To calculate this KPI, divide the total capacity used during a specific period by the total available production capacity.

Production Cost FAQs

The cost of production report is a financial statement that summarizes the total cost of manufacturing a product or service during a specific period. It provides detailed information about the different cost components involved in the production process, including both direct and indirect costs. Understanding the Cost of Goods sold (COGS) is pivotal in grasping the full picture of a manufacturing entity’s financial health.

- Expense recognition is a cornerstone of accrual accounting, which dictates that expenses should be…

- Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design.

- From the accounting records, we see that total direct materials transferred to the mixing department in February were $3,575 and that direct labor and manufacturing overhead totaled $3,640.

Which of these is most important for your financial advisor to have?

That said, there are typically five primary types of costs to know and understand. Balancing all of these demands, like production costs and projected revenue, is a critical element of any business’s success. Understanding how these costs can affect your bottom line is critical for business success. WIP Inventory is not just a financial figure; it’s a snapshot of the production process at a given moment. It provides valuable insights from both financial and operational perspectives, helping businesses to optimize their manufacturing processes and maintain a competitive edge. Understanding and managing WIP inventory is crucial for any manufacturing entity aiming to enhance its production efficiency and financial health.

Ask a Financial Professional Any Question

Weprovide references to the following illustrations so you can reviewthe detail supporting calculations. When you produce an additional unit, you’re going to see an incremental increase in your total cost. This is the marginal product cost and they’re most often related to variable costs. Factory overhead’ is a term used in business management for expenses related specifically with the cost of maintaining the premises, plant and equipment within a factory. Factory overhead costs may include items such as electricity, heat, power, rent, Depreciation on machines or even the supervisor’s salary.

This system records costs at the time they are incurred and it is easier to have control over the job. From the perspective of a financial analyst, the cost of production data is a treasure trove of insights. It allows for a granular analysis of cost behavior and the identification of cost drivers. For instance, a sudden increase in the cost of a particular component could signal supply chain issues or a need for vendor renegotiation. Multiply the cost per equivalent unit by the number of equivalent units for each category of units accounted for.

How much are you saving for retirement each month?

This is where equivalent units are different than the normal formula, but only for beginning inventory. Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. COGS is more than just a number; it’s a multifaceted indicator of a company’s operational effectiveness and financial health. By thoroughly interpreting COGS, businesses can make informed decisions that enhance profitability and competitive advantage.

Production reports seek efficiencies and one area that can always be improved is resources. At this point, their availability can be set, such as vacation days, PTO classified balance sheet and global holidays. Use the team page or color-coded workload chart to see the team’s allocation and balance their workload to keep them working at capacity.

Essentially, this is the total cost incurred for production including any changes to production volume. Prime cost is a component of production cost which includes direct materials, direct labor, and any other costs that can be easily traced to the product. If production managers use project management software, they often have access to reporting features that can assemble this information. ProjectManager is award-winning project and portfolio management software with customizable reports that provide real-time data for more insightful decision-making.

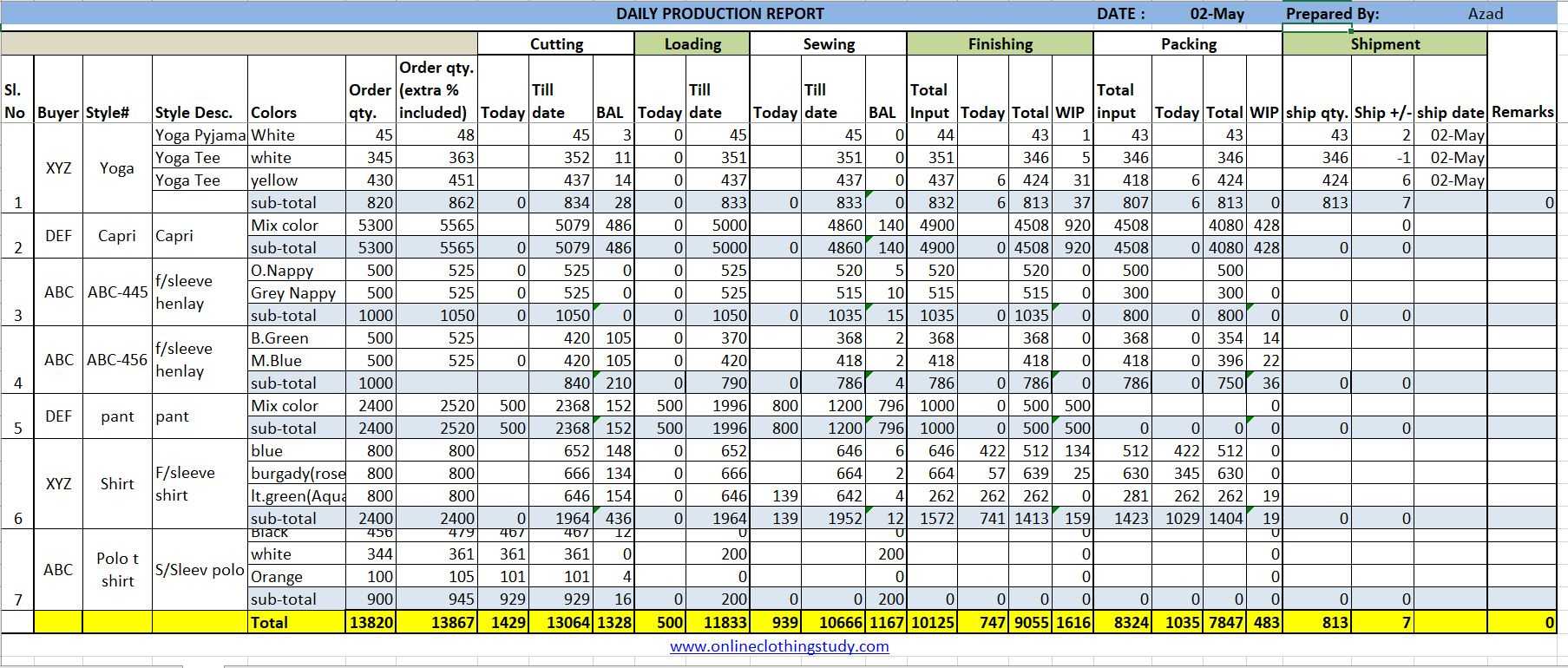

It should reflect strategic goals, be quantifiable and measurable, but also attainable and actionable. The following is a project report example of those fundamental manufacturing KPIs that production managers track. The production cost report for the month of May for the Assemblydepartment appears in Figure 4.9. Notice that each section of thisreport corresponds with one of the four steps described earlier.

This information is summarized nicely in a standard format with the production cost report. From the accounting records, we see that total direct materials transferred to the mixing department in February were $3,575 and that direct labor and manufacturing overhead totaled $3,640. Maintenance costs are all the costs related to the activities in your maintenance schedule. This metric helps production managers monitor the performance of a machine over time with the goal of optimizing equipment availability while keeping costs at a minimum. Maintenance unit cost is the total maintenance expenses required to produce one product unit during a specified period. To calculate maintenance costs, divide the total maintenance costs in a specific time frame by the number of products produced during that same time frame.